Learn How Americans Define Wealth in 2023

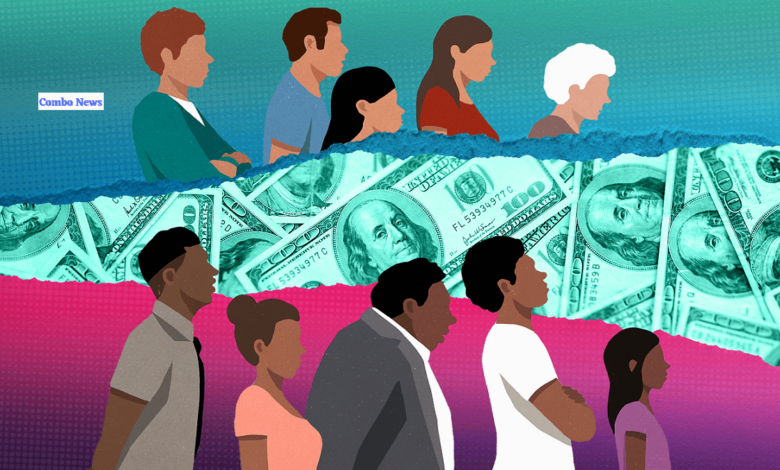

Americans Define Wealth in 2023

The “Americans Define Wealth in 2023“ has typically been reduced to a simple calculation of dollars and cents. The 2023 Modern Wealth Survey by Charles Schwab suggests that this may be changing.

In the past, having a dime was regarded as being wealthier than having merely a nickel. However, the Schwab poll of 1,000 Americans indicated that modern individuals define wealth in broader terms.

Survey participants consistently said that nonmonetary variables influence their perception of wealth more than monetary elements do.

The examples that follow illustrate how, Americans Define Wealth in 2023, wealth will be defined differently in America.

Join 1.2 million Americans who use Money Talks News to save an average of $991.20 each. Register right away for our FREE newsletter.

Sponsored: Find a vetted financial advisor

- It’s not difficult to find a fiduciary financial advisor. The free service from SmartAsset connects you with up to three local financial experts in five minutes.

- SmartAsset has thoroughly investigated each adviser and holds them to a fiduciary standard that requires them to operate in your best interests. Put yourself on the path to attaining your financial objectives.

Having a fulfilling personal life

72% of survey respondents used this Americans Define Wealth in 2023 as opposed to “working on my career”

A fulfilling personal life is vital. The large majority of respondents to the survey who said they prioritize their personal lives over pursuing successful careers indicated that they are aware of this.

Also Read: Systematic withdrawal plan: all you need to know

Not having to stress over money

So, it is entirely sensible to simply be grateful that you don’t have to worry about money as opposed to wanting to be richer than all of your peers.

Enjoying experiences

Instead of “owning many nice things” as their definition of wealth, survey respondents used the following phrase: 70%

Everything in our life, from opulent mansions to swanky sports vehicles, is temporary. everything’s also likely to cost you a lot of money in headaches before everything finally breaks apart.

However, as long as you continue to call this planet home, memories of events might continue to exist in your heart and mind.

Also Read: Cup Loan Program Review: How to Apply, Requirements

Other nonmonetary ways Americans define wealth

Here are some additional things that survey respondents said made them feel wealthy.

- Having a healthy work-life balance: This was preferred by 69% to “maximizing my earnings even if it negatively impacts my work-life balance.”

- Being generous with loved ones now: This was preferred by 67% to “leaving an inheritance.”

- Paying for experiences to spend time with my family now: This was preferred by 64% over “leaving an inheritance for my family.”

- Being in good health: 63% chose this over “being successful.”

- Enjoying healthy relationships with family and loved ones: 62% preferred this over “having a lot of money.”

- Having the flexibility of working where and how I want (in-person, hybrid, remote): 60% chose this over “having a higher salary.”

- Spending money now to have more experiences: 55% of respondents preferred this to “sacrifice experiences now in order to save money for later.”

With Money Talks News, join the 1.2 million Americans Define Wealth in 2023 are saving an average of $991.20. Register for our FREE newsletter right away.

FAQs

What is considered rich in America 2023?

United States Wealth Percentiles Give a Clearer Picture of Your Position Americans Define Wealth in 2023. Americans stated that it requires an average net worth of $2.2 million to be considered affluent in the seventh annual Schwab 2023 Modern Wealth Survey. (Your total asset value less your liability value equals your net worth.)

What is considered rich in India?

In my opinion, to be considered wealthy in metropolises like Bangalore, Mumbai, Delhi, Calcutta, and Chennai, you need make more than 5 lakhs each month and have a net worth of at least 25 crores. For Tier 1 and Tier 2 cities like Ranchi, Pune, Lucknow, Jhansi, and Patna, a monthly income of 2 lakhs and a net worth of 10 crores are sufficient to qualify as wealthy.

Also Read: In-Demand Fintech Jobs in 2023 | Job Opportunities in the Fintech Industry